August saw a dynamic backdrop as the RBA cut rates again, global equities pushed to record highs, and reporting season delivered a mixed set of results. Domestically, the ASX 200 climbed to fresh peaks, though earnings downgrades highlighted growing margin pressures. Internationally, the S&P 500 broke through new all-time highs, while stagflation concerns and tariff tensions created pockets of volatility. Investor focus remains firmly on central bank paths and earnings resilience as we head into September.

Domestic

ASX 200 up ~2.5% in August: The index touched a record high of ~9,054 before easing late in the month as reporting season wrapped. Consumer Discretionary and Health Care outperformed, while Staples and Industrials lagged. Investor focus turned to margins, with earnings downgrades concentrated in export-oriented names.

Reporting Season Wrap: August results showed a mixed scorecard, with an equal split between earnings beats and misses. Forward EPS revisions skewed lower, trimming ~1% off ASX200 FY25–26 earnings growth forecasts. Consensus now expects -3.1% for FY25 and +4.5% for FY26. Investor sentiment remained constructive, with P/E re-ratings for three companies for every two de-ratings, amid supportive global equity conditions.

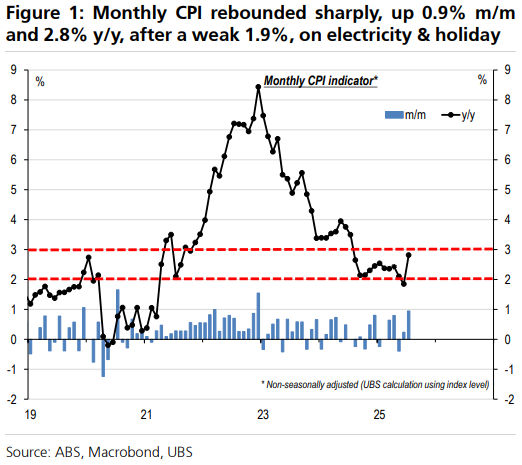

Inflation Rebound: July’s monthly CPI indicator surprised at +2.8% y/y (vs 1.9% in June), driven by electricity and travel. UBS upgraded Q3 inflation forecasts to 0.8% q/q, 2.7% y/y headline and 0.7% q/q, 2.6% y/y trimmed mean—slightly above the RBA’s implied path. While one-off factors should unwind, risks remain skewed to the upside, particularly in housing-related components.

Labour Market & Wages: Q2 wages grew 0.8% q/q and 3.4% y/y, slightly above RBA forecasts (3.3%). Growth was broad-based, led by Utilities, IT, and Healthcare. Real wages ticked higher, but productivity-adjusted wage growth remains elevated (~6% y/y), highlighting sticky cost pressures.

Housing Strength: Dwelling prices rose 0.6% m/m (+3.7% y/y), the third consecutive monthly gain, with regional markets outperforming capitals. Record-low rental vacancies (1.7%) and resilient demand point to further house price growth, expected to exceed +5% y/y over the next 12 months, aided by rate cuts. Rising housing costs could spill into CPI through rents and new dwelling prices.

Monetary Policy Outlook: The RBA delivered a 25bp cut in July, bringing the cash rate to 3.60%. Another 25bp cut is expected later this year (likely November), which would take the terminal rate toward 3.35%. There remains a risk of one further trim to around 3.10% in early 2026 if inflation trends continue to soften.

International

S&P 500 hits fresh all-time high: The index pushed beyond 6,500 points for the first time, driven by resilient earnings, AI-linked momentum, and expectations of a September Fed rate cut. While investor sentiment remains bullish, strategists warn markets are increasingly sensitive to upcoming labour and inflation data, leaving scope for sharp swings.

Global GDP forecasts revised up—but cautious on India & Brazil: S&P Global raised 2025 growth projections for the US, Canada, Eurozone, UK, and China, reflecting stronger Q2 data. Conversely, growth expectations for India and Brazil were downgraded due to escalating U.S. tariffs

US Economy at “Stall Speed”: H1 GDP growth slowed to just 1.2% annualised, with domestic demand weakening. Payroll gains moderated (73k in July), unemployment edged up to 4.25%, and participation fell. Broader underutilisation is trending higher, indicating slack. Labour demand is clearly softening, consistent with restrictive monetary policy.

US Policy Uncertainty: Fed leadership is in focus with speculation around Powell’s successor in 2026. Markets face heightened noise from tariff announcements—recently a 100% tariff on semiconductors and 50% on imports from India—though exemptions (e.g., Apple) highlight political selectivity. Tariff risks remain a persistent overhang.

Tariff war escalates: The U.S. doubled tariffs on Indian goods linked to Russian oil, triggering sharp declines in the rupee and Indian equities. The move strains trade ties and raises the risk of supply-chain re-flow and geopolitical realignment.

China Outlook: Growth remains subdued at ~4% with ongoing property market weakness. Further fiscal stimulus (0.5–1% of GDP) and an additional 20–30bps policy rate cut are expected to stabilise conditions. Trade headwinds from tariffs and weak external demand remain key downside risks.

Looking Ahead

Australia: Focus will be on Q3 CPI and labour market data to confirm whether disinflation persists despite sticky housing and wage dynamics. Reporting season volatility reinforces the importance of stock selection.

US: Labour market data and September’s CPI will be pivotal for the Fed’s policy stance heading into year-end. Tariff escalation adds uncertainty to the growth outlook.

Global Markets: Diverging monetary policy paths (RBA and PBoC easing vs Fed constrained) will drive volatility in currencies and global equity flows.

Fiscal & Sovereign Risks: Rising global bond yields are testing government finances, particularly in the UK and Europe. Sovereign risk premiums could creep higher if deficits persist, creating cross-asset volatility.

“The stock market is designed to transfer money from the active to the patient.”

— Warren Buffett

Ready to Position Your Portfolio for the Next Market Cycle?

At GP Wealth, we help investors navigate structural change with strategies tailored to long-term growth and resilience. Whether you’re seeking to increase your exposure to commodities, leverage AI-driven insights, or safeguard against inflation, our advisers can guide you through every step.

Get in touch with GP Wealth today to discuss how we can help you make the most of the opportunities ahead.