F Scott Fitzgerald, author of The Great Gatsby wrote that “The test of a first-rate intelligence is the ability to hold two opposed ideas in mind at the same time and still retain the ability to function.”

Investing has always been part science and part art. Arguably, as more people use AI, the art becomes more important. The emergence of AI which includes language learning models (analysing company calls), satellite imagery of retail parking lots and quick analysis of company data and valuations means that predicting the future (art- whilst taking into account sentiment and expectations) is the most important aspect.

Structural change is the reason the share market averages a nominal return of 9-10% a year even (real return after inflation of 6-7%) even though GDP growth only averages 3-4%. Leaders of structural change end up taking market share and capturing the majority of earnings while those affected fall by the wayside.

It is why, when analysing companies, it is more important than ever to find a balance between:

Confidence v humility (ability to exit when there is a thesis breakdown)

Patience v urgency (focus on long term earnings but still recognise the need to optimise client capital/ performance)

Management trust v scepticism ( asses management adaptability and their ability to admit and learn from mistakes)

Insights v information (ignore noise over what truly affects long term earnings)

What remains unchanged are cycles and human emotions. It looks like we are currently entering a 80 year commodity cycle known as the Kondratiev wave. This period is known for rising innovation, inflation and commodity demand. This is often clouded by the copious amounts of short term noise today’s society brings.

It appears we are in the early stage of a commodity super cycle as commodities become more strategically important -reasons include:

The energy transition, e.g., need for (Lithium, copper rare earths).

Supply chain constraints from years of underinvestment.

Underinvestment in fossil fuels (due to ESG concerns and lack of bank funding).

Increased global infrastructure and defence spending.

The below quote summarises long term change:

Commodities look like they are early in the below typical pattern.

Traditionally bonds made up 40% of a balanced portfolio (bonds unlike commodities appear in bubble territory). I think this global bond allocation will lower dramatically for two reasons:

They no longer provide protection in share drawdowns (recent share market drawdowns have occurred due to bond selloffs- rising yields).

Inflation will eat away fixed interest returns.

Bonds have lost their protective mechanism in portfolio’s because government debts are at the point of no return so Western governments will inflate their way out at all costs (rather than suffer a sovereign debt crisis).

Commodities have two portfolio benefits over government bonds.

They have become more uncorrelated to equities in share market drawdowns.

They are real assets of importance with inflation protection.

Whilst gold companies have risen substantially in portfolios, I believe we are still early in this investment theme. In 1930, gold was 20% of portfolio’s while today’s average is only 1%.

It also appears we are currently in what is known as the “Fourth Turning”. This is a 80-100 year cycle made up of four turnings or generational eras, similar to seasons. In this period society faces existential threat and major transformation. This period can last 20-25 years and involves survival/ urgency.

In the fourth turning we typically see:

Collapse or radical transformation of institutions.

Widespread societal conflict (political, cultural, sometimes military)

Collective action over individualism.

A push to reset or rebuild society for a new era.

Often ends in a new national or global order.

The convergence of two long term cycles requires looking long while the world is looking short. It is important to ride the wave and not be shaken by the latest bit of noise. Most of market wealth and asset allocation changes are managed by slow movers- these include ETF’s and pension funds (involve asset consultants and quarterly meetings). I believe pension funds will start to embrace the strategic importance of commodities and move away from government bonds.

Lastly, the US just saw the steepest revision in US job numbers since the pandemic. A weak payroll figure is negative for the US dollar and reinforces lower short term interest rates which is positive for precious metals.

There is now a 95% chance of a rate cut in the US in September.

Adding to the dovishness, Fed Governor Adriana Kugler is stepping down and there is room for a Trump advocate (demanding lower rates).

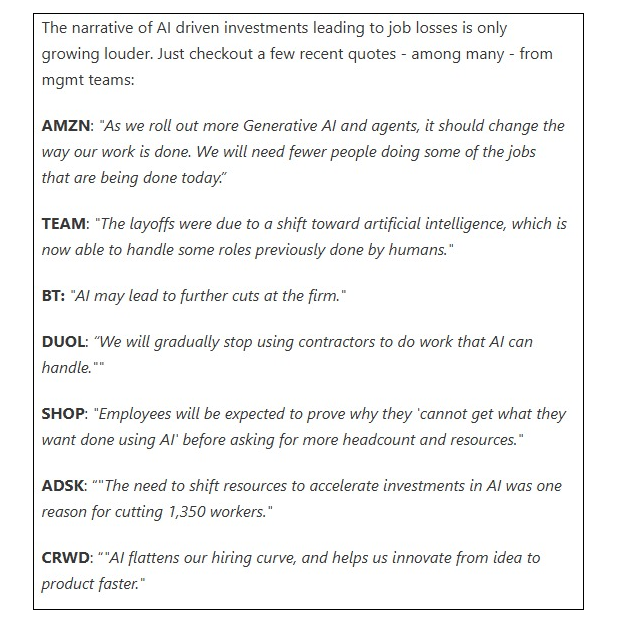

AI would have contributed to the substantial job losses.

China and the US are in a manufacturing and AI race. So far China is ahead in manufacturing (their speed and cost advantage is a key military advantage) but the US is ahead in chips/ AI. Commodities, energy and electricity are key pillars in this race.

It is why Trump wants lower energy prices, lower interest rates and why key materials like rare earths are so important. It is also why Trump wants to grow the economy above interest costs to ensure he does not lose.

It also explains recent news that the US could revalue gold higher to relieve their debt concerns (which will enable them to reindustrialise at a faster rate).

We believe portfolios are correctly positioned for the current climate. Key portfolio over-weights have started the FY strongly including healthcare, gold, silver, copper and uranium; while a number of growth companies have had strong updates (HUB, PNI, HSN, RMD, RPL and REA).

Ready to Position Your Portfolio for the Next Market Cycle?

At GP Wealth, we help investors navigate structural change with strategies tailored to long-term growth and resilience. Whether you’re seeking to increase your exposure to commodities, leverage AI-driven insights, or safeguard against inflation, our advisers can guide you through every step.

Get in touch with GP Wealth today to discuss how we can help you make the most of the opportunities ahead.