Domestic Macro Environment Strengthening

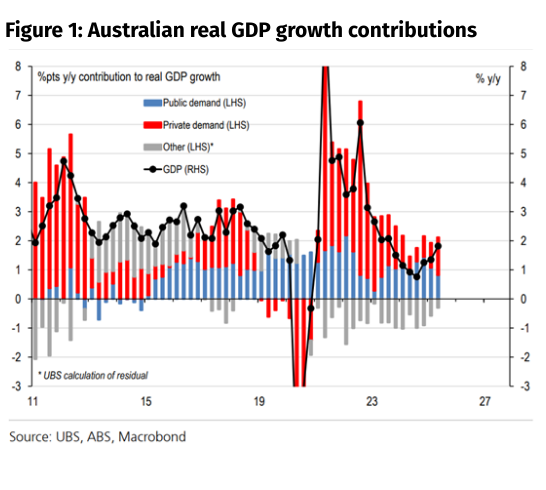

The Australian economy is showing renewed vigour, with GDP growth accelerating to 2.4% q/q annualized – its strongest pace since 2022. This upturn is supported by rising household consumption and dwelling investment, reducing the economy's dependence on public demand. Employment growth continues to outpace the US by double, underscoring a robust domestic labour market amid global softening.

This improved macro environment reverses the recent "winner-takes-all" dynamic that favoured large caps. We now anticipate small caps and value-oriented segments – often more tied to domestic activity – will benefit from this broadening recovery. Historical patterns during past rate-cutting cycles suggest sustained equity gains, with small caps poised for a relative rebound.

Investment Implications – Shifting Towards Small Caps and Cyclicals

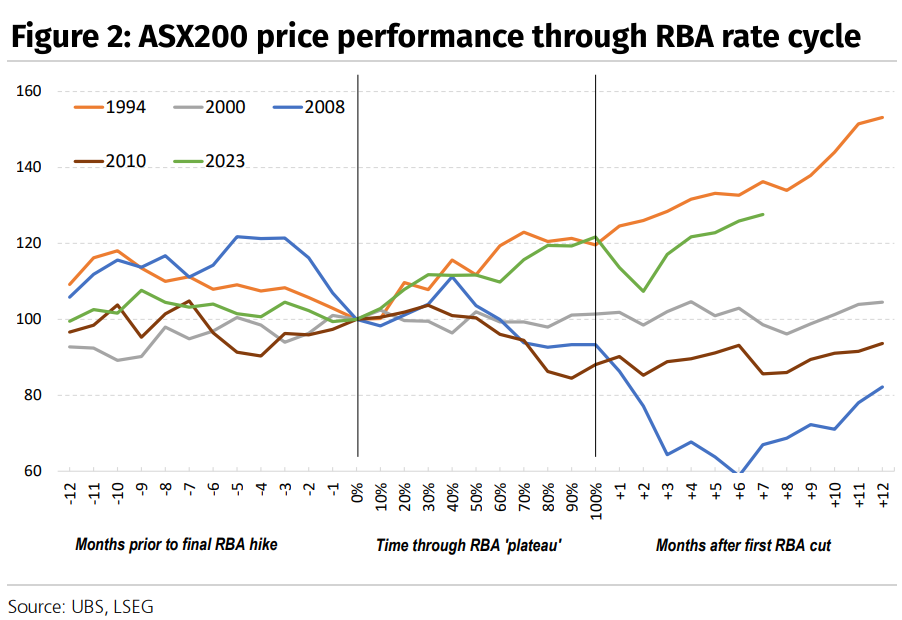

The improved domestic backdrop favours a rotation away from defensives and back towards cyclicality. We have upgraded our stance on domestic small caps from underweight to overweight. Equity markets have historically performed well during RBA rate-cutting cycles. As borrowing costs fall, liquidity improves and earnings expectations stabilise, driving a re-rating in valuations.

This is evident in past cycles which shows the ASX has typically delivered positive returns in the 12–24 months following the first cut, with small caps in particular benefiting from greater sensitivity to domestic growth and credit conditions. In the mid-to-late 1990s cycle, for example, Australian equities produced seven consecutive years of positive returns as monetary easing supported both consumption and investment. Current dynamics suggest a similar setup, with early signs of economic recovery coinciding with the initial stages of monetary policy easing.

While small caps have already lifted off their lows, they continue to trade at a discount to large caps. We believe there is scope for sustained outperformance over the next 12 months, mirroring prior cycles when small caps traded at a premium.

At the same time, market valuations overall remain stretched, with tight credit spreads and low equity risk premiums signalling a “late-cycle” tone. Selectivity in portfolio construction is therefore critical.

Sector Positioning

Our current sector views are:

Overweight: Small Caps, Insurance, Technology/Media/Telecom (TMT), Industrials, Real Estate

Neutral: Consumer Staples, Healthcare (downgraded from overweight after earnings disappointments)

Underweight: Banks, Energy, Infrastructure/Utilities, Mining, Consumer Discretionary

Portfolio Takeaways

Increase allocation to Small Caps: stronger earnings leverage in a domestic recovery.

Rotate into cyclicals: consumer and industrial exposures are well placed.

Be selective in financials: insurance over banks.

Maintain diversification: retain exposure to gold and technology for balance.

Position Your Portfolio for What’s Next

Get in touch with GP Wealth today to discuss the specific stocks we are targeting within these themes and how they may fit within your portfolio.