While many people are calling the top in gold, we believe we are still early in the longer-term bull market. Overnight gold price falls are a normal part of a bull market which are designed to flush out weak holders who have only recently purchased.

It is important to not listen to the latest reasons why this bull market is over (this is just noise). For instance, people purchase gold for geopolitical risk, so they think peace in Ukraine will be a major turning point. However, this is not the major gold driver. Instead, we are amid a re-order of the current financial system.

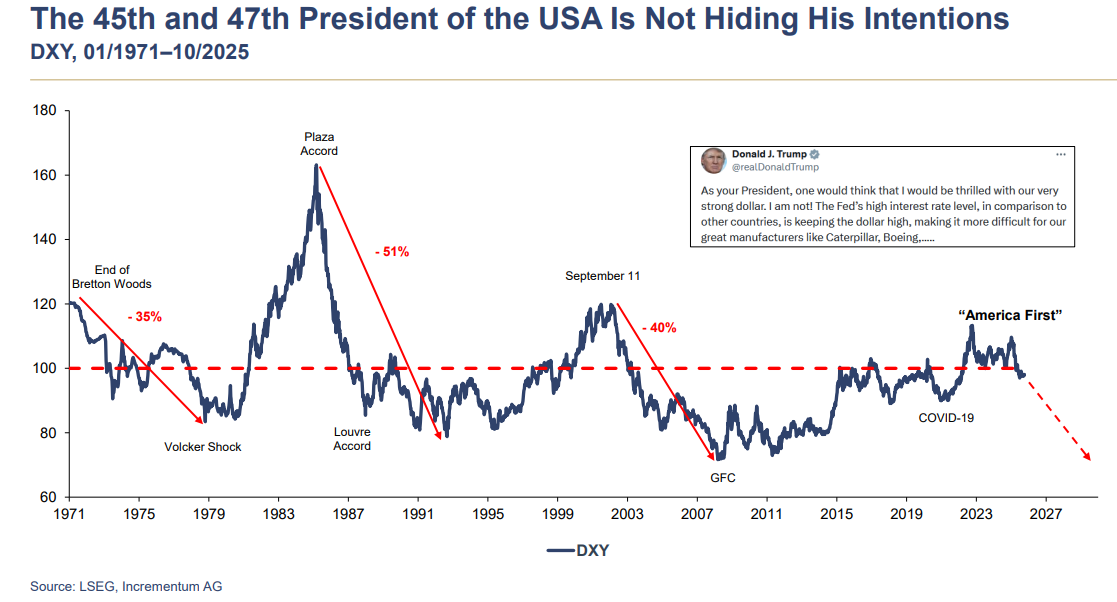

The major driver of the long-term gold price is US currency debasement to strengthen domestic manufacturing and inflate their way out of their large fiscal deficits and high debt to GDP.

We believe any gold retracement will be a bump in the road on the way to far higher prices as the globe resets.

Falls are a natural part of a bull market after recent price rises saw the precious metal appear stretched on short-term charts. Falls would be exacerbated as hedge funds are long on the London exchange and short the Comex exchange (this exacerbates short-term moves).

The important point is that any new gold supply will not affect demand (unlike other commodities) as gold is not consumed.

For some context, we have provided some charts which compare the current gold run versus previous gold bull markets. For instance, in the 1970’s gold gained 19-fold in 10 years whilst it has currently only gained fourfold since 2015.

We have recently seen several “value fund managers” purchase gold stocks. This is due to the rising free cashflows which will result in rising dividends. We remain focused on the large gold miners for clients which provides the safest area of investment. These all benefit from solid management, lower cost operations with solid capital management. Below chart highlights the rising FCF of gold miners.

This is resulting in increasingly strong balance sheets for the major gold miners.

Trump is telling us his playbook! Dollar debasement is key.

How high can gold go?

Some handy stats by market strategist Luke Gromen will provide some ease:

Since China, Russia, Iran and Latin America have begun trading commodities in Renminbi and settling surplus dollars in gold, it is worth remembering that the gold market is less than 1/10th the size of the commodity market (large upside from here is increasingly possible). But the below analysis of US treasuries as a % of Foreign held treasuries shows the real upside potential!

One final point: ignore short-term noise and remain long-term focused. The below chart highlights the asset allocation of family offices. This currently sees a 2% allocation to gold/precious metals. Many investment banks have recently recommended 20% allocations to gold and a smaller bond allocation (as bonds no longer provide diversification or inflation protection). Hence, a large amount of buying still awaits!

Please note, our individually managed discretionary portfolios will have varied exposure to gold depending on individual client’s risk appetite.

Consequently, the current fall in gold and gold miners provides a longer-term buying opportunity.

Stay informed with our team’s exclusive complimentary market insights and strategic updates. Click this link to join our distribution list.