Following a constructive start to 2026, January delivered solid gains across global equity markets, supported by resilient earnings momentum, a renewed lift in commodities (despite recent moves), and notable currency moves. While inflation dynamics remain challenging – particularly in Australia – market performance was buoyed by earnings upgrades, a stronger Australian dollar, and continued leadership from resources and energy. Globally, growth remains uneven, but equity markets continue to look through near‑term policy uncertainty toward sustained earnings delivery.

Domestic

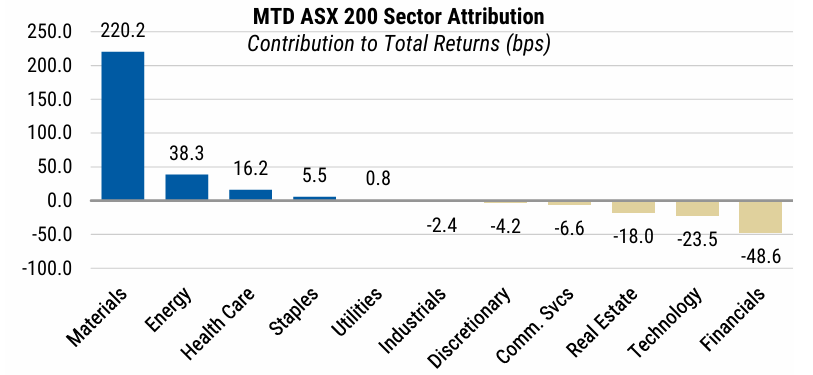

ASX 200 Starts 2026 Higher: The ASX 200 rose +1.8% in January, led by Energy (+10.6%) and Materials (+9.5). Performance was concentrated in resources, while Technology (-9.4%) and REITs (-2.7%) lagged. Small caps continued to outperform large caps, extending leadership over the past 12 months.

Earnings Momentum Improves: Aggregate consensus earnings were revised higher through January, with FY26e growth now tracking around +11%. Materials remained the dominant contributor to upgrades, reinforcing the ongoing rotation toward commodity-linked sectors.

Inflation Still Too High: Q4 trimmed mean CPI printed at 0.9% q/q and 3.4% y/y, materially above RBA forecasts. Headline CPI rose to 3.6% y/y, keeping underlying inflation well above target and reinforcing the 25bp RBA rate hike.

Australian Dollar Breaks Higher: The A$ appreciated sharply through January, rising above US$0.70 for the first time since early 2023. The move was supported by rate differentials, resilient domestic demand, and a shift in RBA expectations, and has historically coincided with relative outperformance of Australian equities.

Domestic Activity Mixed but Resilient: Business conditions remained above average, capacity utilisation stayed tight, and consumption indicators continued to surprise on the upside. Consumer sentiment eased modestly in January but remains consistent with real consumption growth slightly above 2% y/y.

*The RBA have increased the cash rate by 25 basis points to 3.85% at its February meeting*

International

Global Markets Start 2026 Firmly: Global equity markets delivered a solid start to 2026, with the S&P 500 up 1.5%, and Developed Markets gaining 1.7% over January. Emerging markets outperformed, supported by strength across Asia ex-Japan, while US equities advanced more modestly amid rate and valuation sensitivity.

US Earnings Season Firm: Around one‑third of the S&P 500 has reported, with aggregate earnings beating expectations and 4Q EPS growth tracking in the high‑single to low‑double digit range. Technology continues to dominate earnings growth, though signs of improving breadth are emerging.

US Growth Moderates, Inflation Constraints Persist: While growth momentum has softened, the US economy remains supported by earnings resilience. Inflation remains sticky enough to limit near‑term policy easing, keeping the Fed cautious despite late‑cycle signals.

Precious Metals Volatility: Gold and silver saw a sharp, disorderly sell-off late in the month following an extended momentum-driven rally. The move reflected crowded positioning, thin liquidity, and forced deleveraging, amplified by a shift in US policy expectations that lifted the US dollar and real yields. Despite this, Gold and Silver finished up 13.2% and 18.8%, respectively.

China GDP Meets Expectations: China reported Q4 GDP growth of 5.2% y/y, taking full-year 2025 growth to 5.0% y/y, broadly in line with official targets. While headline growth was supported by policy stimulus and infrastructure spending, underlying momentum remains uneven, with property investment still weak and domestic demand reliant on ongoing policy support.

Looking Ahead

Central Bank Divergence: Australia appears on the cusp of further tightening as inflation re‑accelerates, while global peers remain more balanced between growth risks and inflation control. This divergence is likely to drive continued currency and sector‑level dispersion.

Earnings Versus Valuations: Equity valuations remain elevated in parts of the market, placing greater emphasis on earnings delivery. Resources and energy continue to offer relative earnings support, while high‑multiple growth sectors remain sensitive to rates.

Key Catalysts to Watch: Ongoing US and Australian earnings updates – Inflation prints across major economies – Developments in China policy support and commodity demand

“Far more money has been lost by investors trying to anticipate corrections than lost in the corrections themselves.” — Peter Lynch

Stay informed with our team’s exclusive complimentary market insights and strategic updates. Click this link to join our distribution list.