As 2025 unfolds, Australian investors are facing an increasingly complex market landscape. At GP Wealth, our mission remains clear: to help our clients grow and preserve wealth by aligning portfolios with global macro trends, value-driven opportunities, and forward-looking investment themes.

From the recent overvaluation of key Australian stocks to emerging opportunities in healthcare, uranium, AI, and gold, our expert insights and portfolio positioning reflect a disciplined approach rooted in long-term fundamentals and intelligent diversification.

Valuations and Vigilance: The Case of CBA

In the short term, markets can be driven by popularity, momentum, and passive capital flows. As Warren Buffett aptly stated, "In the short term, the market is a voting machine, but in the long term, it's a weighing machine."

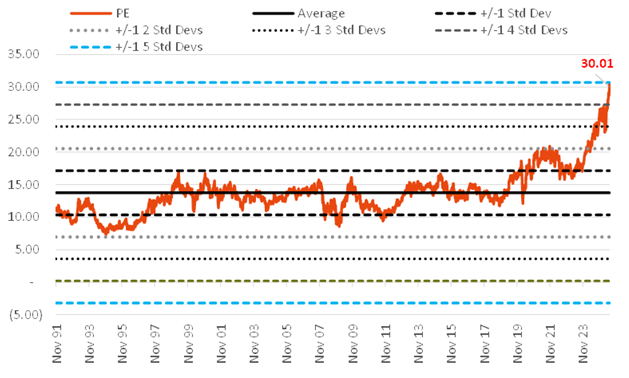

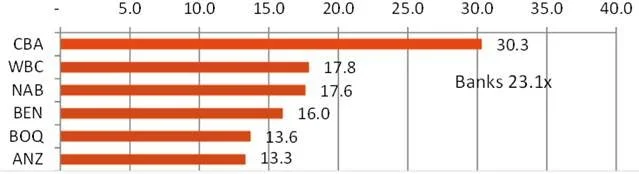

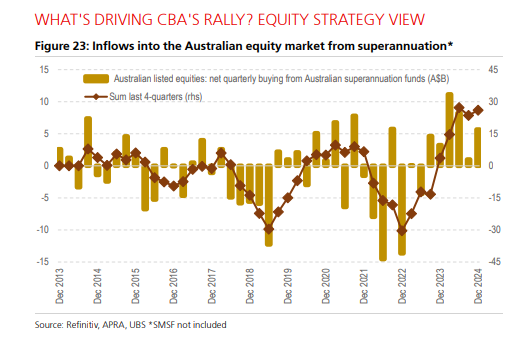

Take Commonwealth Bank (CBA) as a prime example. According to Regal Partners' Investment Director Charlie Aitken, CBA represents "the biggest single-stock bubble I've seen in 30 years." With a PE ratio now five standard deviations above its long-term average, driven more by index weight gains than earnings growth, CBA's recent performance raises questions about sustainability.

While CBA has added $64 billion in market cap for a $357.7 million profit increase (marginal PE of 179x), other stalwarts like CSL and BHP have seen valuation compression despite relatively minor changes in earnings. Such dislocations highlight the importance of active portfolio management and the risks of passive overexposure.

BHP: A Value-Rich Opportunity

Despite facing a 13% decline year-to-date, BHP offers significantly greater strategic value compared to overvalued market darlings. As one of the world’s largest diversified miners, BHP is well positioned to benefit from global demand for copper and other critical materials—essential for infrastructure, energy transition, and technological advancement.

Its current valuation presents a compelling case: unlike CBA, BHP’s earnings decline has been modest, yet its market cap has been punished disproportionately. With a marginal PE of just 3.4x, BHP stands out as a fundamentally sound, undervalued asset poised for recovery and long-term performance.

We believe BHP’s global exposure, commodity leverage, and disciplined capital management make it a core holding for investors seeking resilient, long-duration growth.

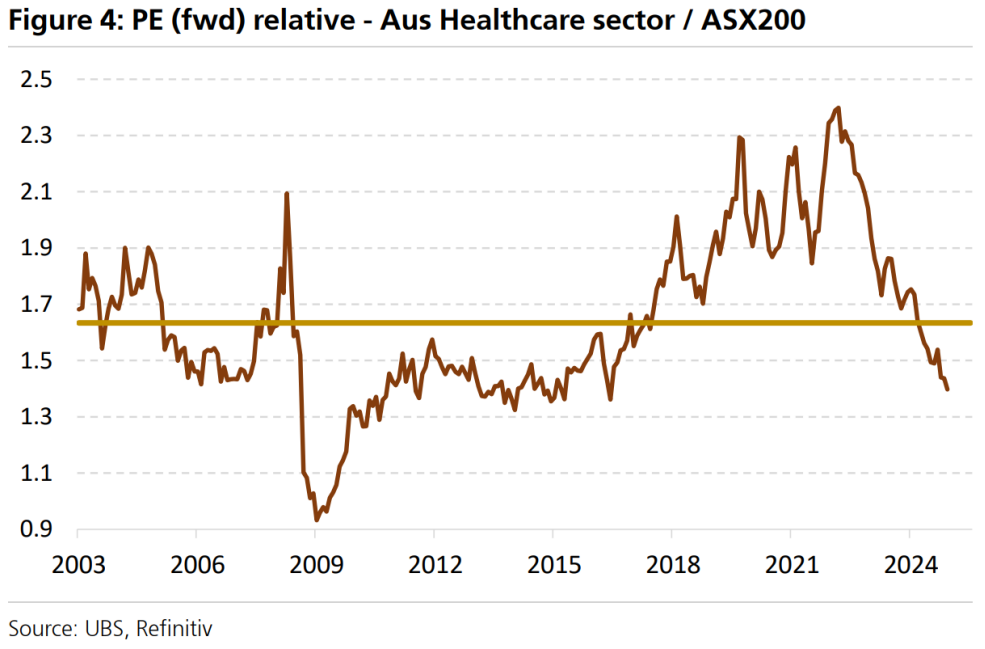

Healthcare: A Rare Opportunity in Defensive Growth

Australian healthcare is now trading at one of the most attractive valuations in over a decade. Following three years of earnings downgrades, the sector appears to have found a floor, offering investors a rare opportunity to acquire high-quality names at discounted levels

Key indicators:

Relative PE valuations are at 10-year lows

Earnings revisions risk is now minimal

Macro headwinds are stabilising, setting the stage for mean reversion

Healthcare names present a compelling combination of growth and defensiveness—essential traits for wealth preservation during uncertain times.

Uranium: Building Momentum

Uranium continues to gain traction as a critical pillar in the future energy mix. Several catalysts support the bullish outlook:

The World Bank and IAEA partnership to support nuclear energy in developing nations

Rising uranium spot prices and aggressive restocking by SPUT

Accelerated timelines for U.S. nuclear projects and China's growing reactor build-out

This is a long-term structural opportunity benefiting from both energy security demands and ESG alignment—especially attractive to forward-thinking HNWIs.

Artificial Intelligence: A New Frontier for Earnings Growth

The AI revolution is here, and it is reshaping industries globally. Weekly active users of AI tools like ChatGPT now exceed 600 million. Tech leaders like Meta and Google are rolling out AI-driven innovations that will transform business models and consumer behaviour.

Investors positioned in companies leveraging AI or enabling the infrastructure behind it—like data centres, chips, and software—stand to benefit significantly. Exposure to this trend is vital for wealth growth in a digitising economy.

Gold: Real Asset Appeal in an Era of Expanding Debt

Despite recent gains, gold continues to offer strategic upside for portfolios concerned with real rates, currency debasement, and geopolitical risk. With governments globally maintaining high levels of spending and the U.S. facing massive debt refinancing at higher yields, gold's store-of-value appeal remains strong.

Additional tailwinds include:

A weakening USD under expected Trump-era policies

Rising defence budgets

Historical gold/silver ratio dynamics suggesting further runway

Gold’s low correlation to equities makes it an essential asset for preserving wealth, especially when inflation-adjusted returns are top of mind.

Our Positioning: Growth with Disciplined Risk Management

At GP Wealth, our portfolios remain strategically tilted towards:

Undervalued global defensive growth names

Copper, gold, and uranium miners aligned with macro themes

AI-exposed companies with scalable earnings models

BHP and other fundamentally sound Australian equities trading at compelling valuations

As passive funds continue to dominate capital flows, the mispricing of risk and opportunity grows. For investors, this environment calls for a return to fundamentals: quality, valuation, and strategic insight.

We remain confident that the coming 12 months will be more favourable for active management and bottom-up stock selection—two pillars of long-term wealth creation and preservation.